In Summary

▪︎On March 17, 2023, Unilever Nigeria, the local unit of British multinational consumer goods company Unilever Plc, announced it would fold up the production of its homecare and skin-cleansing brands ( Omo, Sunlight and Lux)

in Nigeria. “The production for home care category ceased in June 2023, and sales ceased in September 2023.

▪︎ On August 3, 2023, GSK Plc (Headquartered in the UK) closed down it’s Nigerian subsidiary GlaxoSmithKline Consumer Nigeria Plc, after over 51 years.

▪︎ In November, Sanofi, a French pharmaceutical multinational, announced its exit from Nigeria.

The company said it had appointed a third-party distributor to handle its commercial portfolio of medicines from February 2024.

▪︎ On November 14, Bolt Food announced plans to exit Nigeria by December 7, 2023 due to business reasons.

▪︎On December 6, Procter & Gamble the American multinational, leader in consumer goods, has announced plans to transition its Nigerian operations to an import-only model, effectively dissolving its on-ground presence in Nigeria.

Reasons For Exits

The outgoing year 2023 has proven to be exceptionally challenging for Nigerian businesses, especially the manufacturing industries.

Despite the introductions and the implementations of the federal government’s monetary and fiscal policies to boost the performance of the sector, the operators continued struggling with familiar challenges, YoY ( Year on Year). This has led to numerous companies downsizing or closing operations in Nigeria.

Here’s are the real reasons these companies closed their production plants in preferences for importing their brands from other countries to Nigeria.

Andre Schulten, Procter & Gamble’s Chief Financial Officer, said during his presentation at the Morgan Stanley Global Consumer & Retail Conference, noted that operating in certain markets, such as Nigeria and Argentina, has become increasingly difficult due to their macroeconomic realities.

He said that as a result, the company is implementing a restructuring program to optimize its operating model and portfolio, focusing on markets with greater potential.

P&G produces a range of products for the Nigerian market, including Always sanitary pad, Pampers, Ariel detergent, Oral B toothpaste, and Gillette shaving stick.

The Chief Financial Officer (CFO) revealed that Nigeria contributes $50 million in net sales to the business. Considering the company’s overall portfolio valued at $85 billion, he does not expect any significant impact on the group’s balance sheet in terms of sales or profitability.

Similarly, Unilever also blamed inflation, foreign exchange and other macroeconomic challenges affected its operating profit and performance.

Unilever ’s Secretary, Abidemi Ademola, had in a corporate notice to the Nigerian Exchange Limited, noted that the company wants to find better economic opportunities in other markets that are both sustainable and profitable.

Further, Sanofi’s Country Manager, Folake Odediran, also blamed the the company’s exit on ” scarcity of forex which made it difficult to maintain supplies of its pharmaceutical and vaccine products in Nigeria; noting that the company’s financials indicated that operating in Nigeria had been a tall order.”

In the same vein, Bolt Food said that a significant increase in fuel price caused the company to raise delivery fees by 20-50 per cent in an economic environment where consumers’ spending power has been greatly eroded by rising inflation.

” Underpinning all this is the business environment, an environment where the inflation rate is at high levels and the exchange rate is volatile”

Reactions from Manufacturers Body

Checks by Industrialtimesngr, shows that the above complaints regarding the country’s harsh business environment, was not exaggerated by the affected companies.

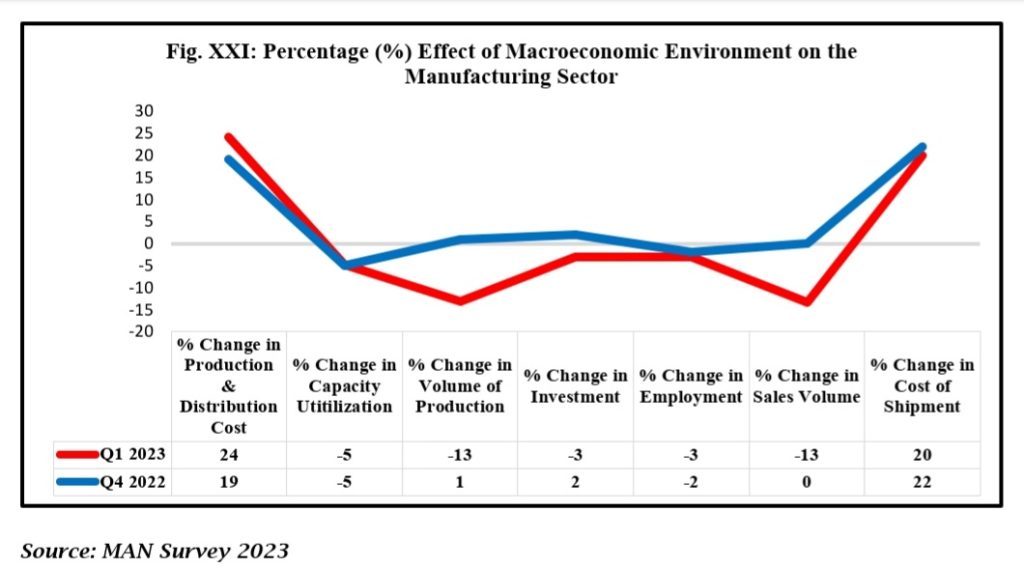

Manufacturers Association of Nigeria MAN CEO’s Confidence Index (MCCI) report in the first quarter of 2023, recorded that manufacturers production and Distribution costs escalated by 24% in the quarter under review much higher than the 19% increase witnessed in the preceding quarter.

Also factories capacity utilisation nosedived further by 5% in the quarter under review similar to the contraction witnessed in the preceding quarter.

Manufacturing investment dropped by 3% in the first quarter of 2023 from 2% increase recorded in preceding quarter;

Manufacturing employment reduced further by 3% in the first quarter of 2023 from 2% contraction recorded in preceding quarter; sales volume plummeted by 13% in the first quarter of 2023 against the stable record witnessed in the preceding quarter; cost of shipment rose by 20% in the first quarter of 2023 though witnessed a slowdown from the 22% increase recorded in the fourth quarter of 2022.

The President of the Manufacturers Association of Nigeria, Francis Meshioye, warned that more international manufacturing companies may leave Nigeria and site their factories in other countries.

He added that the N144 billion spent on alternative energy sources by manufacturers in 2022 impacted adversely on the operations of his members.

Segun Ajayi-Kadir, the Director-General of MAN, expressed regret over the departures of the multinational manufacturers , warning that more manufacturers might do the same.

He emphasized that unless the Federal Government implements clear, well-defined measures to address the challenges faced by manufacturers in the country, more departures from the manufacturing sector are likely.

He stated, “We received the news of P&G’s exit with sadness, but it was not entirely unexpected. More may follow because we operate in a challenging environment.”

Ajayi-Kadir stressed that manufacturing is a strategic choice for any economy, and the government must decide whether it wants to industrialize its country.

Once that decision is made, all necessary steps must be taken to eliminate the constraints that hinder the performance of that sector. He pointed out that Nigeria has not done this, which is why closures are occurring.

He noted that the exit of multinationals from the country should serve as a lesson to the government and an opportunity to promote local manufacturers more than foreign investors, as this is more sustainable.

He said, “The fact that the big ones exiting are multinationals should send a clear signal to the government. As regrettable as it is, it should guide future actions. We need to be strategic in what we promote.”

Moreso, Adewale-Smatt Oyerinde, the Director-General, Nigeria Employers’ Consultative Association (NECA), noted that in the last few years, hitherto strong brands like GSK, Nampak and now P&G and some other local brands have either closed shop or divested fully or partially.

He said that these regrettable departures will persistently undermine the Federal Government’s efforts to attract Foreign Direct Investment, rendering its initiatives highly ineffective.

Highlighting on the factors behind these businesses closure, he said : “the challenging business landscape, marked by stringent regulatory and legislative activities, insufficient infrastructure, and policy inconsistencies, all conspired to exacerbate the difficulties faced by businesses.

“When established global brands like P&G cannot survive the environmental and regulatory onslaught, it is worrisome how many more businesses will capitulate.

Regulatory bodies tasked with fostering business growth persist in prioritizing revenue generation at the expense of their core mandate, while legislators, in the guise of oversight functions, consistently create impediments for organized businesses, hindering their operations.”

Again, Olusegun Aganga, a former Minister of Industry, Trade and Investment, noted that the manufacturing sector has been deindustrializing rather than improving and getting bigger.

In his analysis of countries manufacturing sector’s contributions to the GDP, he said that in other countries, manufacturing GDP are above 25 percent but that in Nigeria, it’s below 10 percent.

” That is not where we should be as a nation.

Underpinning all this is the business environment, an environment where the inflation rate is at high levels and the exchange rate is volatile , and a large percentage of our national income is being spent on debts servicing , cannot stimulate our economic needs,” he said.

▪︎Cover Picture: Doris Uzoka-Anite, Minister of Industry, Trade and Investment