The Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA), is calling on the Central Bank of Nigeria (CBN) to act quickly to pay the outstanding balance of the 2022 to 2023 foreign exchange forwards to the affected companies.

Conversely, CBN Governor, Olayemi Cardoso, maintained that the bank would not pay for FX requests that are not validly constituted, adding that the bank had written to authorised dealers to explain the disparities identified.

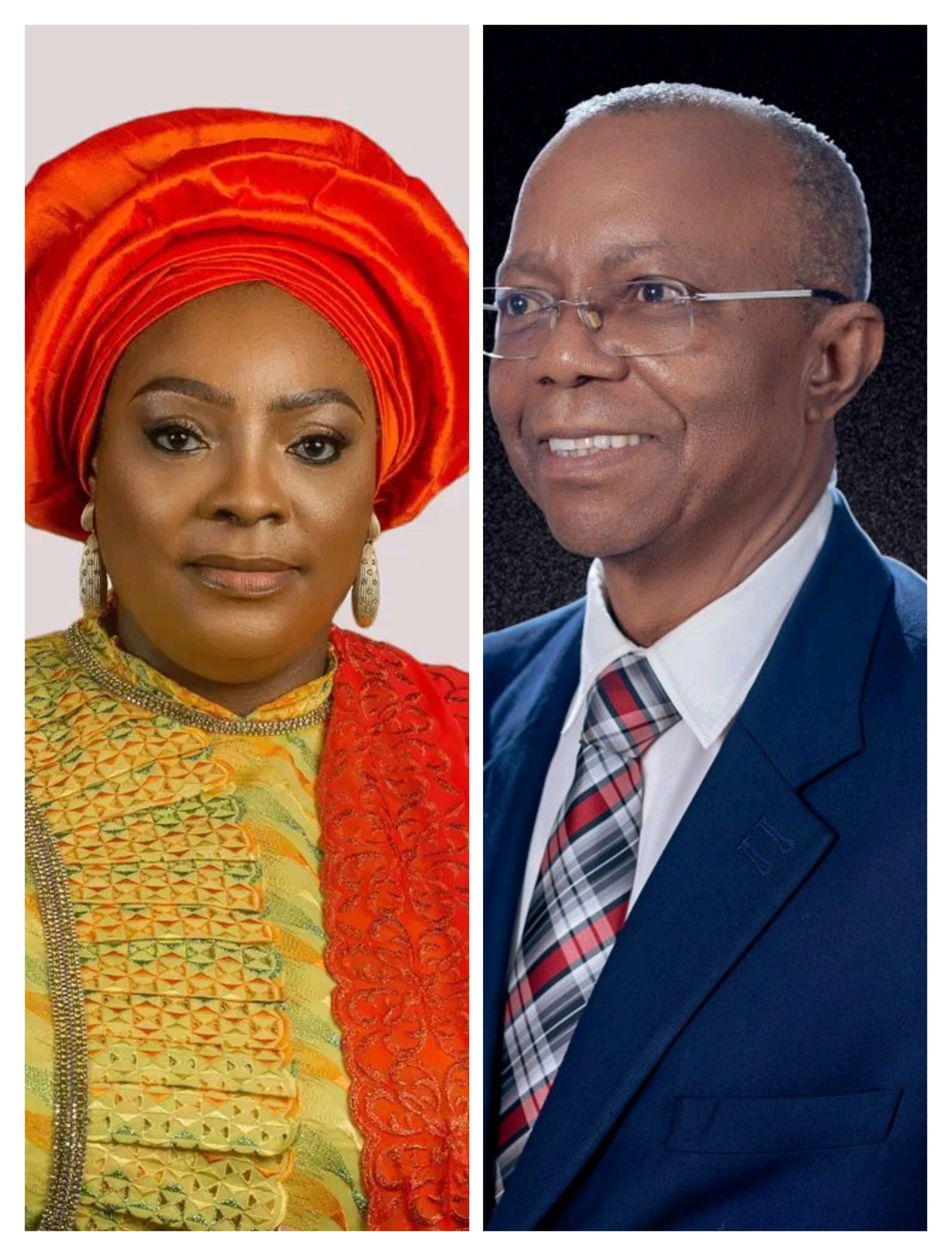

Dele Oye, the National President of NACCIMA, who made the appeal yesterday, lamented that the non-payment of Foreign Exchange (FX) forwards had severely crippled affected companies, pushing many towards bankruptcy.

He said that the businesses and banks involved are now burdened with exorbitant interest rates, averaging over 35 percent.

Oye also said that the financial strain had damaged the companies’ reputations and strained relationships with international trading partners, who are perplexed by the CBN’s failure to honour its commitments.

He further claimed that the CBN’s actions have eroded trust and credibility, significantly harming the country’s financial standing on the global stage.

He urged the CBN Governor, Mr. Olayemi Cardoso, to reconsider the bank’s stance and pay the balance of the FX forwards to the affected companies.

Earlier in March, the CBN announced that all valid FX backlogs owed to various sectors of the economy had been settled, fulfilling a key pledge of the CBN Governor, Mr. Olayemi Cardoso, to process an inherited backlog of $7 billion in outstanding liabilities.

In a recent interview with Arise Television, Cardoso revealed that about $2.4 billion out of the acclaimed $7 billion outstanding foreign exchange liabilities of the federal government were not valid for settlement.

“He said while the bank had settled verified FX requests which amounted to $2.3 billion at the time, the total outstanding FX obligations remained at $2.2 billion.”

The central bank governor further indicated that part of the headline $7 billion outstanding FX claims were not valid, citing the outcome of a forensic audit by Deloitte Management Consultant which the apex bank commissioned.