(Industrial Times, Nigeria)

Today, the Manufacturers Association of Nigeria (MAN) says that banks lending rates to the manufacturing industry are too high to promote productivity in the sector.

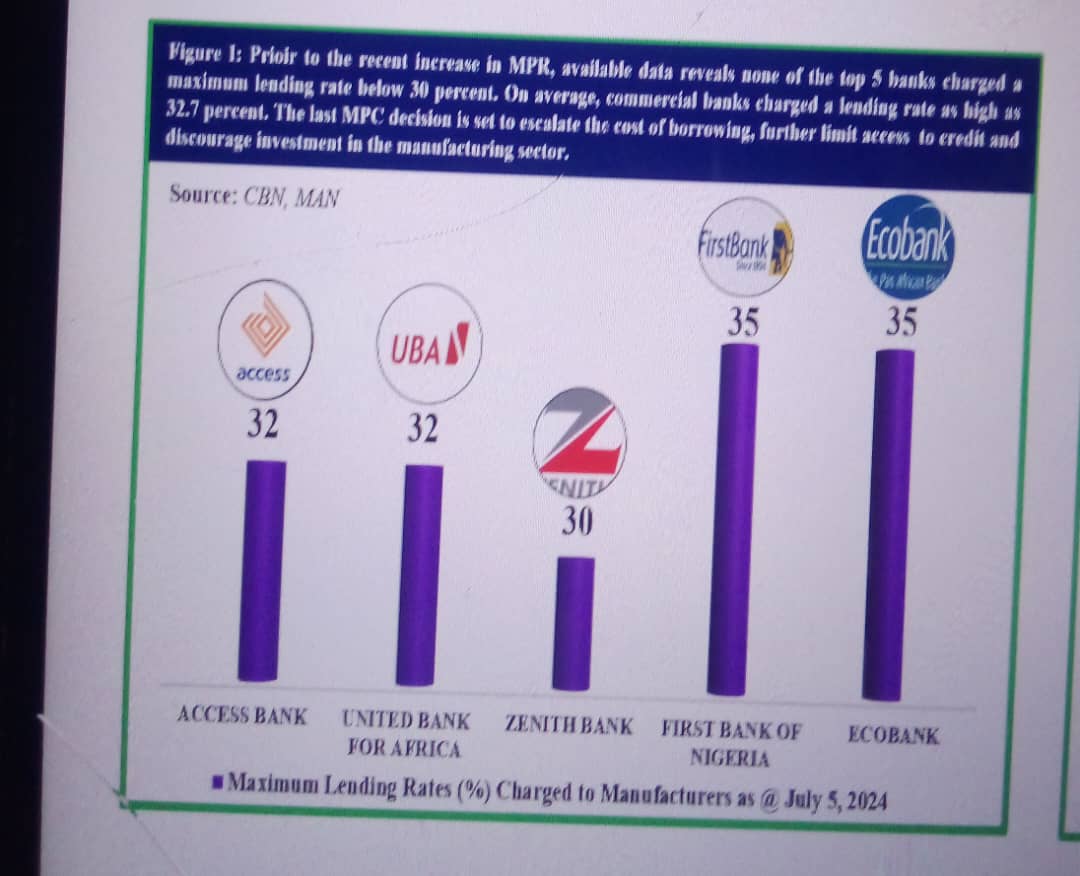

Data obtained from the Association, shows that the maximum lending rates by the commercial banks range from 30 – 35 percent.

Top Five Banks Lending Rates

Access Bank 32% , Ecobank 35%, First Bank 35%; UBA 32% , while Zenith Bank charges 30%.

MAN, in its CEO’s Confidence Index (MCCI) survey results for the second quarter (Q2 2024), shows that only 21.9 per cent of manufacturers interviewed agreed that the bank lending rate encouraged productivity in the sector in Q2 2024, while 70.2 per cent disagreed.

“The CEOs lamented the adverse effects of the aggressive decisions of the Monetary Policy Committee on the manufacturing sector”

The survey further reveals that only 32.6 percent of manufacturers interviewed agreed that the size of commercial bank loans to the manufacturing sector encouraged productivity in Q2 2024 while 58.8 percent disagreed.

The report noted that due to the Federal Government’s commencement of the disbursement of the ₦75 billion loan, the percentage of CEOs in agreement that size of bank loans encourages productivity rose slightly by 6.5 percentage points.

However, the CEOs lamented the adverse effects of the aggressive decisions of the Monetary Policy Committee on the manufacturing sector.

The 150 basis-point hike in the benchmark interest rate from 24.75 percent to 26.25 percent in May further escalated the cost of borrowing, restricted access to credit and discouraged productive investment in the manufacturing sector.

By the end of the second quarter, average prime and maximum lending rates for manufacturers had risen to 22.43 percent and 32.73 percent respectively.

These were exorbitantly too high to promote productivity in the sector.

In addition, the narrowing of the asymmetric corridor to +100/-300 in late March also reduced the incentives of Deposit Money Banks (DMBs) to lend to the manufacturing sector in the early periods of the second quarter.