China-based Huaxin Cement Co Limited has so far acquired six subsidiaries of LafargeHolcim cement plants in Africa.

Huaxin Cement moves to be the second biggest cement producer in Sub-Saharan Africa after Dangote Cement. .

Dangote Cement has a total production capacity of 52 million tonnes per year (MTa) across Africa. This makes it the largest cement producer in Sub-Saharan Africa.

Here are some of Dangote Cement’s production capacities in different African countries: Nigeria: Dangote Cement’s home market, with a production capacity of 35.25 MTa. The Obajana plant in Kogi state is the largest in Africa, with a capacity of 16.25 MTa.Cameroon: A 1.5 MTa cement grinding facility that opened in 2015.Congo: An integrated production plant.Ghana: A 2.0 MTa clinker grinding and import facility.Ethiopia: A 2.5 MTa facility.Senegal: A 1.5 MTa facility.Sierra Leone: A 0.5 MTa import facility.South Africa: A 2.8 MTa facility.Tanzania: A 3.0 MTa facility.Zambia: A 1.5 MTa facility.

Global Cement reported the details of the Huaxin Cement acquisitions: Holcim holds a relationship with Huaxin Cement that dates back to the late 1990s when it first bought a stake in the company.

Following the formation of LafargeHolcim in the mid-2010s, Lafarge’s subsidiary, Lafarge China Cement, was sold to Huaxin Cement.

At the end of 2023, Holcim reported that it owned just under a 42% share in the company. Huaxin Cement has also bought assets from Holcim as the latter company has divested subsidiaries over the last decade.

In 2020 it purchased African Tanzanian Maweni Limestone from ARM Cement. In 2021 it bought Lafarge Zambia and Pan African Cement in Malawi from Holcim. This adds to other acquisitions in the region.

Later in 2023, it picked up InterCement’s subsidiaries in Mozambique and South Africa. In addition, in October 2024 local media in Zimbabwe reported that the company was planning to build a grinding plant.

On December 2, 2024, Huaxin Cement revealed that it is buying Holcim’s majority stake in Lafarge Africa for US$1 billion.

The details of the deal are that Holcim has agreed to sell its 83% share of Lafarge Africa to Huaxin Cement.

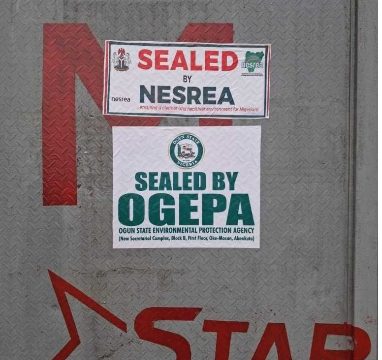

Lafarge Africa operates four integrated cement plants in Nigeria at Sagamu and Ewekoro in Ogun State, at Mfamosing in Cross River State, and the Ashaka Cement plant in Gombe State.

It has a combined production capacity of 10.5Mt/yr. The transaction is expected to close in 2025 subject to regulatory approvals.

Huaxin Cement said it had an overseas cement grinding capacity of just under 21Mt/yr at the end of 2023.

This figure included plants in Cambodia, Kyrgyzstan, Nepal, Oman, Tajikistan, and Uzbekistan.

Data from the Global Cement Directory 2024 suggests that the company now has 10 integrated cement plants in Sub-Saharan Africa with a cement capacity of around 18Mt/yr.

It also operates a number of grinding plants in these countries. The Lafarge Africa deal is significant because a mainland China-based cement producer has finally hit the US$1 billion window in merger and acquisition (M&A) activity overseas.

During its 116 years of operations, Huaxin Cement has established itself as a leading company in China as well as the global cement industry.

For over two decades, Huaxin Cement has consistently maintained an average annual compound growth rate of 25%, securing its place as one of the top 10 manufacturing companies in China.

Huaxin Cement operates across over 300 branches and subsidiaries within China and overseas, working across multiple sectors, such as cement, concrete, and environmental protection.

To maintain competitiveness, the global firm consistently innovates its processes, including its award-winning low-carbon manufacturing technology, which has the potential to cut carbon emissions by 664,000 tons per year.

Based in Wuhan, Huaxin Cement remains committed to its local community and environmental initiatives, hosting various charitable events throughout the year. Its latest activities include fundraising for schools and organising tree planting campaigns for local mountains to improve the ecosystem surrounding its operations.