Diageo Plc, a British multinational alcoholic beverage company, with its headquarters in London, England, has announced the sale of its majority stake in Guinness Ghana Breweries to the Castel Group for $81 million.

The transaction will see the UK-based beverage giant part with its 80.4% shareholding in the Ghanaian unit while retaining ownership of its Guinness brand and other key labels produced by Guinness Ghana.

These will continue to be licensed to the brewery under the new ownership. This move aligns with Diageo’s ongoing strategy to adopt a “flexible and asset-light” beer operating model, which is designed to adapt to local market conditions and enhance operational efficiency and profitability.

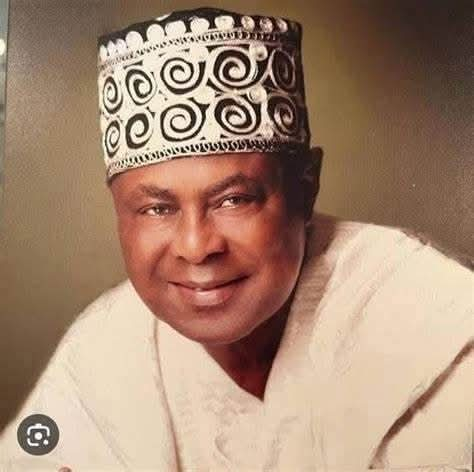

“Guinness Ghana has consistently delivered strong performance, driven by an exceptional team,” said Dayalan Nayager, President and Chief Commercial Officer of Diageo Africa.

“Through this transaction, we anticipate the Guinness brand continuing to flourish and achieving sustained growth under Castel’s leadership.”

The sale follows a series of divestments by Diageo in its African beer business, including its stakes in Guinness Nigeria in 2024 and Guinness Cameroon in 2022, both of which were also acquired by Castel. In January 2022, Diageo sold its Meta Abo Brewery in Ethiopia to the Castel Group as part of its broader portfolio reshaping in Africa.

Marketing Edge reported that Group CEO Gregory Clerc expressed enthusiasm for the acquisition, stating: “This purchase underscores Castel’s entrepreneurial spirit and represents a significant step forward in our growth ambitions across the African continent.”

The announcement comes amid recent media speculation about Diageo’s potential divestment of its Guinness business and its 34% stake in LVMH’s beverage alcohol division, Moët Hennessy. However, Diageo has firmly denied such rumors

.“We want to address the recent speculation regarding the Guinness brand and our stake in Moët Hennessy,” Diageo said in a statement issued on January 26. “We can confirm that we have no intention of selling either.

We look forward to providing further updates during our interim results announcement on February 4 and at our Guinness investor and analyst day on May 19-20.”

This latest sale marks a continuation of Diageo’s strategic focus on streamlining its operations while ensuring the Guinness brand remains a cornerstone of its African business portfolio.