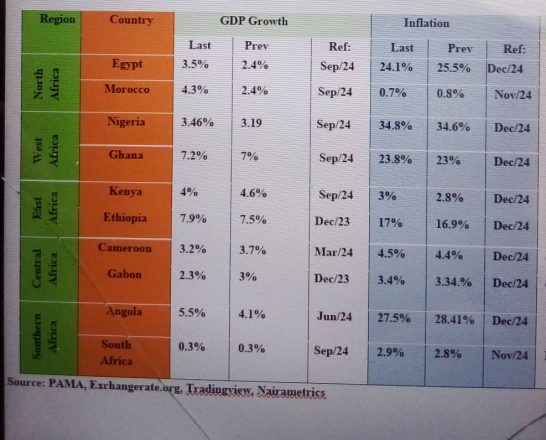

The Pan African Manufacturers Association (PAMA) is looking forward to the top ten countries on the continent that are poised to attract significant foreign direct investment inflow in 2025.

PAMA has identified these promising nations by analyzing their GDP, inflation, exchange rate, and interest rate trends over the past two years.

Engr Mansur Ahmed, the President of PAMA, foresees that Ethiopia, Ghana, Morocco, Kenya, and Nigeria will emerge as key destinations for investment inflows, based on their favorable macroeconomic indicators.

Additionally, Egypt, Gabon, South Africa, Cameroon, and Angola are expected to be in the spotlight as well. In his outlook for Africa’s manufacturing sector in 2025,

Engr Ahmed anticipates notable improvements in performance and strategic opportunities, supported by increasing investments in local production, enhanced regional market integration through initiatives like the AfCFTA, and a broader adoption of human-machine collaboration.

While Africa is expected to remain relatively insulated from the protectionism wave in U.S. international trade policy, the ongoing US-China trade tensions could significantly boost foreign investment inflows into Africa, particularly in the automotive, textiles, and electronics sectors.

However, he acknowledges that key risks remain, with some challenges from 2024 likely persisting alongside new hurdles, such as stricter sustainability regulations and rising costs driven by factors like freight rate spikes.

These elements may require bold innovation, strategic adaptation, and collaborative efforts to navigate successfully. He envisions the manufacturing sector growing moderately in 2025, propelled by stronger regional integration, technological advancements, greater investor confidence, rising interest in local production, and an intensified commitment to zero-defect manufacturing aimed at reducing waste and enhancing efficiency.

While Africa is expected to remain relatively insulated from the protectionism wave in U.S. international trade policy, the ongoing US-China trade tensions could significantly boost foreign investment inflows into Africa, particularly in the automotive, textiles, and electronics sectors.

PAMA anticipates that cross-border value chains in Africa will expand, especially in agro-processing, textiles, metallics, and automotive industries.

Countries like Egypt, Rwanda, Nigeria, and Angola are likely to experience positive growth trajectories, driven by revamped investment policies and improved regulatory reforms. Conversely, slower manufacturing growth may be anticipated in regions grappling with severe conflict, such as the DRC.

Overall, FDI inflows into Africa’s manufacturing sector are projected to grow modestly by around 4% in 2025, as global investors are expected to seek opportunities amid improving economic conditions and the potential spillover effects of the shift in trade dynamics toward Africa.

Nonetheless, the geopolitical landscape and ongoing conflicts may still present challenges that could deter potential investors from entering key sectors of interest.

You’re so interesting! I do not believe I have read

a single thing like that before. So great to find another person with a few unique thoughts on this topic.

Seriously.. thanks for starting this up.

This web site is one thing that is needed on the web, someone with a bit of originality!

Every weekend i used to pay a quick visit this website, for the reason that i want enjoyment,

since this this site conations in fact pleasant funny data

too.

That is very attention-grabbing, You’re an overly professional blogger.

I have joined your feed and stay up for seeking more of your wonderful post.

Additionally, I’ve shared your site in my social

networks

Hey there, You’ve done an excellent job. I will definitely digg it and personally recommend to my friends.

I am sure they’ll be benefited from this web site.

I’m truly enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more

enjoyable for me to come here and visit more often. Did you hire out a developer to create your

theme? Exceptional work!

Way cool! Some very valid points! I appreciate you penning this post plus the

rest of the website is very good.

I was wondering if you ever considered changing the layout of your site?

Its very well written; I love what youve got to say.

But maybe you could a little more in the way of

content so people could connect with it better.

Youve got an awful lot of text for only having 1 or 2 images.

Maybe you could space it out better?

This is my first time pay a quick visit at here and i am in fact pleassant to read

all at one place.

Very soon this web page will be famous among all blogging

and site-building users, due to it’s fastidious articles or reviews

Have you ever considered about adding a little bit more than just

your articles? I mean, what you say is valuable and everything.

But think of if you added some great photos or video clips to

give your posts more, “pop”! Your content is excellent but with images and video clips,

this blog could undeniably be one of the very best in its field.

Amazing blog!

I was able to find good information from your content.

I think the admin of this web site is truly working hard in favor of his web site, for

the reason that here every data is quality based material.

Excellent pieces. Keep posting such kind of info on your page.

Im really impressed by your blog.

Hey there, You have performed an excellent job.

I’ll certainly digg it and personally recommend

to my friends. I am confident they’ll be benefited from this site.

Whoa! This blog looks just like my old one! It’s on a totally different topic but

it has pretty much the same page layout and design. Superb choice of colors!

Keep this going please, great job!

This is my first time go to see at here and i am really happy to read

everthing at single place.

I really like your blog.. very nice colors & theme.

Did you design this website yourself or did you hire someone to

do it for you? Plz reply as I’m looking to create my own blog and

would like to find out where u got this from.

thanks a lot