SHAREHOLDERS of Lafarge Africa PLC, have approved the sale of Holcim Group’s 83.81% stake in the company to Huaxin Cement Ltd.

The shareholders gave their nods during the 66th Annual General Meeting in Lagos, Nigeria, given that it will mark a pivotal step toward future expansion and innovation.

This is contrary to a recent directive by the Senate to the Bureau of Public Procurement to halt the planned sale of Lafarge Africa to Chinese producer Huaxin Cement on ‘national security and economic sovereignty grounds.

The Senate expressed concerns that the deal could lead to capital flight, job losses and reduced regulatory oversight over a sector vital to national development.

Holcim, which owns an 84% stake in Lafarge Africa, initially announced the company’s sale to Huaxin Cement for US$1 billion in December 2024.

The transaction is set to complete in 2025, pending regulatory approvals.Senator Shuaib Afolabi Salisu said “We cannot afford to wake up one day and realise that our cement industry, one of the backbones of our economy, is entirely in foreign hands.

We must ensure that strategic assets like Lafarge Africa remain in the hands of those who have the country’s best interests at heart.”

Senator Olamilekan Adeola said “The company is about to be divested and the transaction has been shrouded in secrecy. What the motion is simply asking for is that we want this transaction to be as transparent as possible.

By the time the eventual sale of this company is done, we will be fully satisfied that Nigeria’s economy will be protected.”

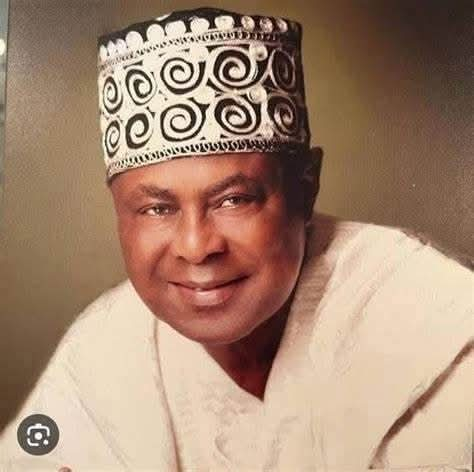

At the 66th AGM , the company’s Chairman Gbenga Oyebode , announced a remarkable revenue of ₦696.76 billion for the 2024 financial year.

This represented a 72 percent increase from ₦405.50 billion in 2023.

Operating profit grew by 89 percent to ₦193 billion, while profit after tax surged to ₦100 billion, a 96 percent increase over 2023.He emphasized Lafarge Africa’s commitment to excellence, sustainable growth, and shaping Nigeria’s infrastructure for future generations.

The Group Managing Director/CEO Lolu Alade-Akinyemi highlighted the company’s dedication to innovation, sustainability, and operational excellence.

He noted that the company’s remarkable performance despite economic challenges demonstrates its strategic focus and commitment to delivering superior value to stakeholders.

Shareholders approved a final dividend of ₦1.20 kobo per share, reinforcing the company’s commitment to delivering value to its stakeholders.

Eric Akinduro, Chairman of the Ibadan Zone Shareholders’ Association, commended the company’s leadership for their commitment, discipline, and professionalism.

He expressed confidence that Lafarge Africa’s financial performance will continue to improve year after year.Lafarge Africa prioritizes sustainable practices, including reducing carbon emissions and accelerating green growth.

The company has adopted calcined clay in cement production, developed eco-friendly products, and expanded its green logistics framework.