• CBN monetary policy committee members

The Manufacturers Association of Nigeria (MAN) reacted today to Central Bank of Nigeria (CBN) July interest rate cut.

The Association is complaining that the persistent increase in the rate over the years has impacted the sector negatively, especially the disruptions on manufacturing production and investment plans.

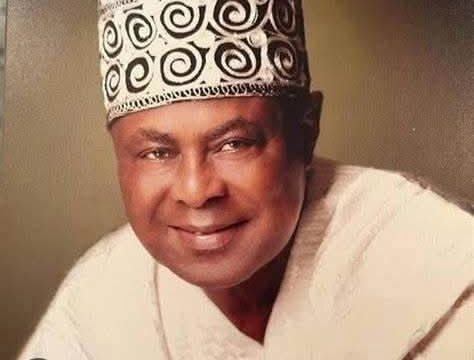

Segun Ajayi-Kadir, MAN Director- General, said ” The same 27.50 percent MPR rate adopted months ago surged the cost of borrowing, as the average lending rate to manufacturers stood at more than 35 percent as of January 2025.

“The rate also had trickle-down effects on production cost, impacting prices of finished products, capacity utilisation, inventory of unsold goods and competitiveness negatively.”

Ajayi-Kadir emphasised: “MAN expects to have a rate cut that is supported by a robust fiscal policy framework capable of facilitating improved access to long-term loans, enhanced productivity and sustained economic growth.”

Segun Ajayi-Kadir, MAN Director- General, said ” The same 27.50 percent MPR rate adopted months ago surged the cost of borrowing, as the average lending rate to manufacturers stood at more than 35 percent as of January 2025.

He said that the Association acknowledges the efforts of the Monetary Policy Committee to stabilise the monetary parameters and address inflationary pressure.

However, maintaining the current rate is not sufficient to address the inflationary pressure and to reposition the economy on the path of growth.

It is necessary to consider a rate cut to reduce the cost of borrowing and attract investment in the real sector.”