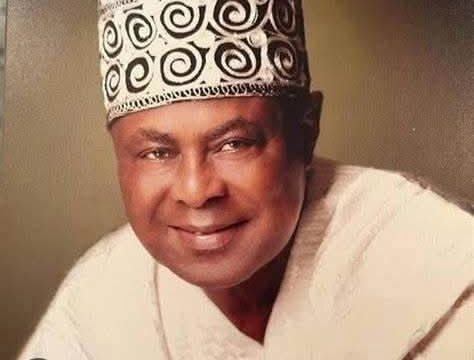

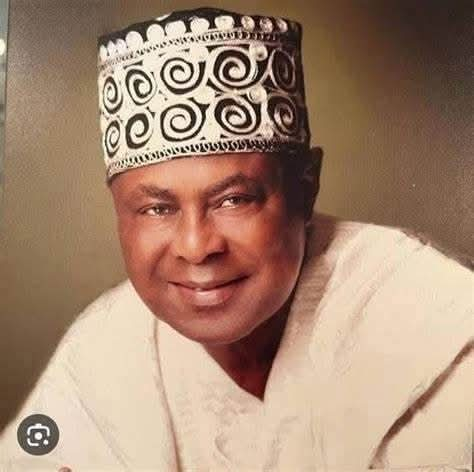

Image: FIRS chairman , Dr Zacch Adedeji

The Federal Inland Revenue Service (FIRS) has announced that registered businesses will no longer need a separate Tax Identification Number, as their Corporate Affairs Commission (CAC) registration (RC) number will now function as their Tax ID.

The Service made the disclosure on its official X handle on Monday, ahead of the passage of the Nigeria Tax Administration Act (NTAA), one of the new tax laws introduced as part of the Federal Government’s broader fiscal and tax reform agenda .

The new tax law is scheduled to come into force in January 2026 and mandates the use of a Tax ID for certain financial and economic transactions, including banking-related activities.

However, the FIRS stressed that the requirement for a Tax ID is not entirely new. It explained that similar provisions have existed since the Finance Act of 2019, but have now been consolidated and strengthened under the NTAA.

Under the new framework, the Tax ID will unify all previously issued Tax Identification Numbers by the FIRS and state internal revenue services into a single, harmonised identifier.