The Nigerian Association of Chambers of Commerce, Industry, Mines, and Agriculture (NACCIMA) is calling on the National Assembly to carefully evaluate the consequences of the proposed removal of tax exemptions for investors operating within the country’s Free Trade Zones (FTZs) as outlined in the Nigeria Tax Bill 2024. Currently, there are 50 FTZs in Nigeria, with 48 established through private-sector investments.

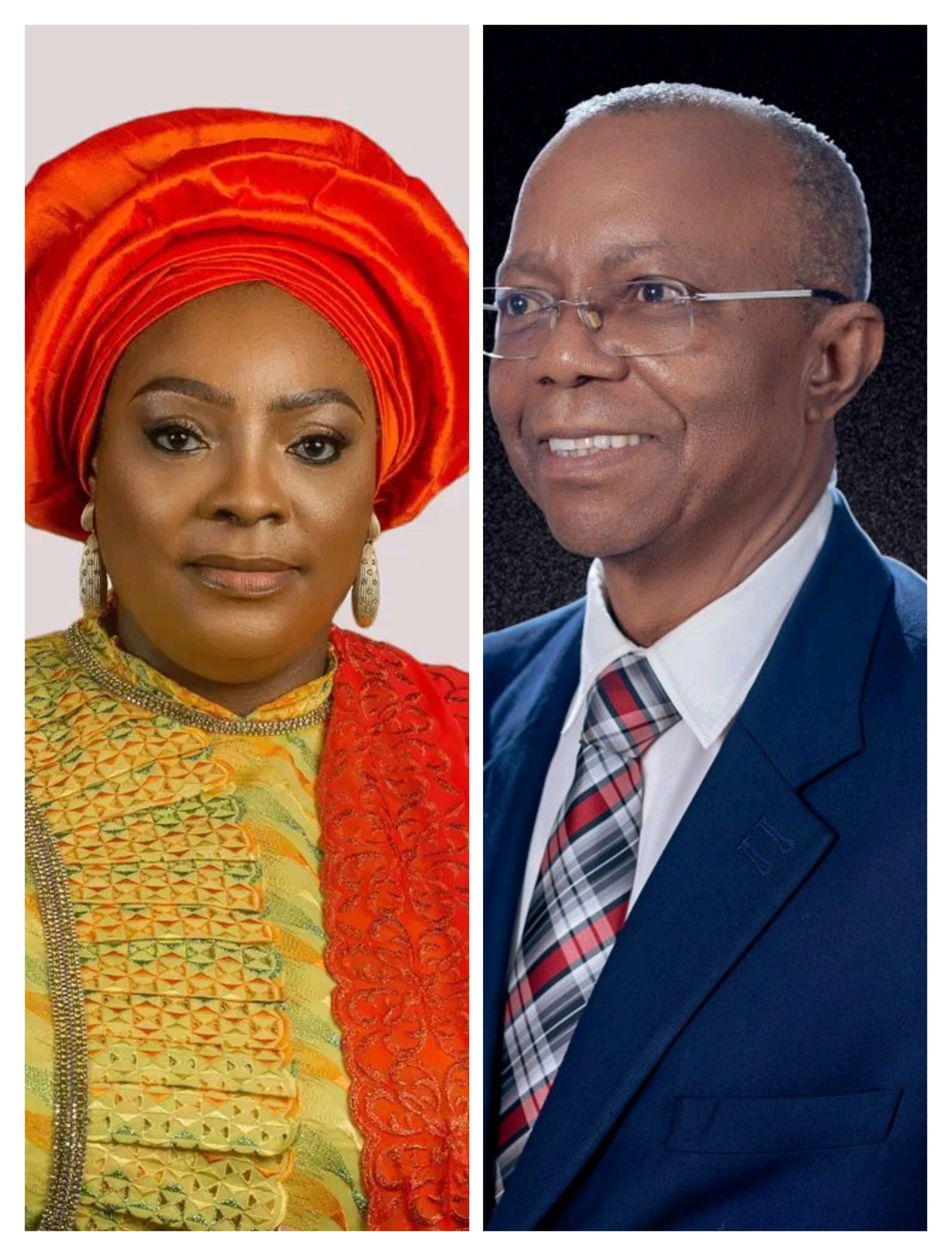

The National President of NACCIMA, Mr. Dele Oye, has expressed serious concerns regarding the proposed amendments, specifically Sections 57, 60, 198(2), and 198(3), which jeopardize key incentives that have been vital in supporting investments in FTZs since the introduction of the Nigeria Export Processing Zones Act in 1992.

The proposed tax reforms aim to implement minimum tax rates and eliminate long-standing tax exemptions for businesses operating within these zones.

Mr. Oye emphasized that the removal of established tax exemptions represents a significant step back that could diminish investor confidence and adversely affect Nigeria’s reputation in the global investment landscape.

As Chairman of Nigeria’s Organised Private Sector (OPS), Mr. Oye highlighted the considerable contributions that businesses within the FTZ scheme have made to Nigeria’s economy since its establishment in 1992.

The provision of special tax incentives was designed to attract foreign investment, stimulate job creation, and promote industrialization.

However, the proposed amendments contradict the foundational principles of the FTZ framework by introducing minimum tax rates and revoking essential exemptions that have played a crucial role in drawing investments.

Notably, these tax exemptions have been instrumental in attracting investors, generating employment, and contributing over N650 billion in government revenue through customs duties and associated economic activities.

Furthermore, it is concerning that stakeholders were not adequately consulted before the announcement of these tax reforms.

Mr. Oye pointed out that the FTZ association and relevant companies were not formally engaged before February 20, 2024, when Mr. Taiwo Oyedele, the Chairman of the Fiscal Policies and Tax Committee, informed the FTZ community about the intended substantial amendments to the regulations governing investments in the FTZ.