The Central Bank of Nigeria (CBN) has granted Moniepoint Microfinance Bank, OPay, Kuda Bank and other fintech national licences to operate across Nigeria rather than within restricted regions.

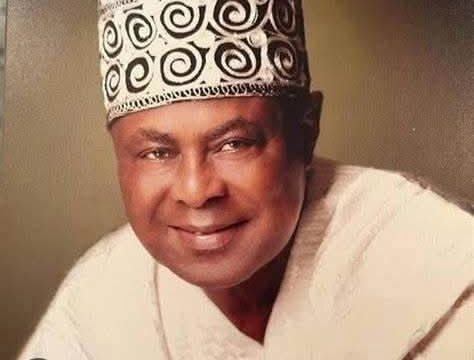

Director of the Other Financial Institutions Supervision Department at the CBN, Yemi Solaja, announced the development during the annual Committee of Heads of Banks’ Operations (CHBOs) conference held in Lagos.

Solaja emphasised that the digital lenders and payment service providers had expanded their operations beyond the limits of their original licences, prompting the regulator to formally update their authorisations to reflect their nationwide reach.

The CBN said the move is aimed at strengthening regulatory oversight of fast-growing fintech operators while sustaining momentum in the expansion of financial inclusion nationwide.

Solaja explained that following the upgrade, national microfinance banks must now maintain a minimum capital base of about ₦5 billion, alongside stricter reporting, governance and risk-management requirements.

Licensed institutions are required to establish physical branches or service centres in key locations, improving access for customers who need in-person support.

Expanded oversight and physical outlets are expected to enhance complaint handling, transaction reversals and customer redress mechanisms.